Hospital Operating Margins Unchanged in April, Non-Labor Expenses Continue to Climb, According to New Strata Data

Gross revenues mark two straight years of monthly year-over-year growth

CHICAGO – May 28, 2025 – Persistent growth in labor and non-labor expenses continued to pressure hospital and health system finances in April, as organizations experienced minimal to no change in operating margins for the month, according to new data from Strata Decision Technology.

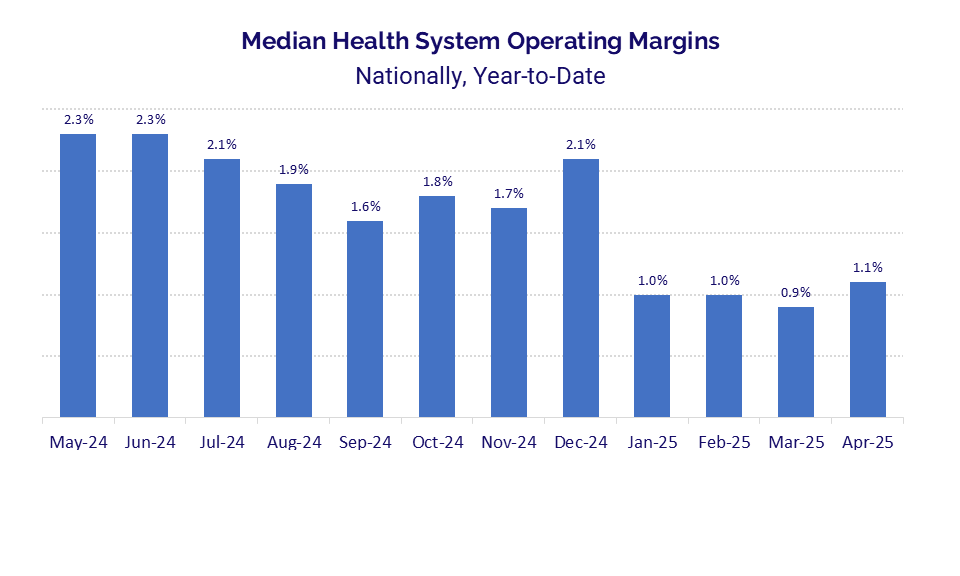

U.S. health systems saw only a slight increase, with the median year-to-date (YTD) health system operating margin rising from 0.9% in March to 1.1% in April, for a fourth consecutive month of narrow fluctuations as the metric continues to hover around 1%. At the same time, hospital operating margins were stagnant for the month. The median change in hospital operating margin — which tracks percentage-point shifts in hospital margins over time — saw no change in April both month over month and year over year (YOY). The median change in operating earnings before interest, taxes, depreciation, and amortization (EBITDA) margin also saw minimal change, decreasing 0.3 percentage point YOY and increasing just 0.1 percentage point from March to April 2025.

"April marked a milestone — two years of steady growth in median gross revenues for hospitals nationwide,” said Steve Wasson, Strata’s chief data and intelligence officer. “Yet even as gross operating, inpatient, and outpatient revenues rise, expenses continue to climb, driven in part by escalating drug and supply costs. Healthcare leaders should stay closely attuned to variations in performance as financial pressures are likely to mount in the coming months as the industry feels the impacts of federal policy changes and other economic factors.”

The data show that gross hospital operating, inpatient, and outpatient revenues have all grown YOY each month for the past 24 months, consecutively. Outpatient revenue saw the largest YOY increase in April, rising 9.7%, while inpatient revenue rose 5.5% YOY, and gross operating revenue increased 8.5% YOY. By census region, YOY outpatient revenue increases ranged from 8.2% for hospitals in the Midwest to 12.3% for hospitals in the West.

Outpatient revenue also grew 2.6% from March to April 2025 for hospitals nationally, but gross operating revenue remained flat, and inpatient revenue declined by 4.4%. Bad debt and charity care as a percent of gross revenue was flat both YOY and month over month in April.

Growth in non-labor expenses once again outpaced labor expense increases for the month, with total non-labor expense up 7.7% YOY, driven by an 8.5% jump in supply expense, a 7.9% rise in purchased service expense, and a 5.6% increase in drugs expense.

Total labor expense increased 6.1% and total expense rose 6.8% from April 2024 to April 2025. Across U.S. census regions, YOY increases in total non-labor expense ranged from 5.3% for hospitals in the Northeast to 8.7% for those in the West. Nationally, hospitals saw some improvements on a month-over-month basis. From March to April 2025, total non-labor expense increased 0.8%, but total labor expense decreased 2.6% and total expense was down 0.6%.

Patient demand remained on the rise YOY across most metrics in April, with outpatient visits seeing the largest gain at 4.9%, while inpatient admissions rose 2%. Observation visits were nearly flat, up just 0.1%. Emergency visits were the only category with a YOY decrease, falling 1.9%. Many hospitals saw patient volumes decline month over month. Emergency visits dropped 7.1%, observation visits decreased 3.3%, and inpatient admissions were down 3.0%. Outpatient visits, however, rose 2.9% from March to April 2025.

About the Data

This report uses data from Comparative Analytics and Strata’s StrataSphere® database. Comparative Analytics offers access to near real-time data drawn from more than 135,000 physicians from over 10,000 practices and 139 specialty categories, and from 500+ unique departments across more than 1,600 hospitals. Comparative Analytics also provides data and comparisons specific to a single organization for visibility into how their market is evolving. StrataSphere is a unique and comprehensive data-sharing platform that helps providers leverage the power of a network that represents approximately 25% of all provider spend in U.S. healthcare. This report incorporates data from more than 650 hospitals from over 120 health systems with StrataJazz® Decision Support.

About Strata Decision Technology

Strata Decision Technology, LLC provides a cloud-based, enterprise performance platform for software, and data and service solutions to help organizations better analyze, plan, and perform in support of their missions. More than 2,300 organizations rely on Strata’s StrataJazz and Axiom solutions for financial analytics, planning, and performance management. Named the market leader for Business Decision Support for more than 15 consecutive years, Strata delivers first-class solutions and service, with an intense focus on accelerating innovation. For more information, please go to www.stratadecision.com.

Strata Social Networks

LinkedIn: Strata Decision Technology

Media contact:

Sally Brown, Inkhouse