Do you know which clients generate your greatest profit, and what client types your bank, credit union, or farm credit association should pursue to maximize profitability?

Among financial institution clients, only 20% create economic profit, with the top 1% creating the most profit. On the other hand, 30% of clients don’t generate profits at all.1

Axiom™ Relationship Profitability and Pricing System (RPPS) helps institutions identify complex relationships, gauge the profitability of each, incent employees, and price according to risk, relationship, and other factors to provide appropriate returns.

Take these 5 steps to improve the profitability of your banking relationships:

- Define relationships

- Identify top and bottom performers

- Manage risk appropriately

- Price based on the relationship

- Incent based on profitability

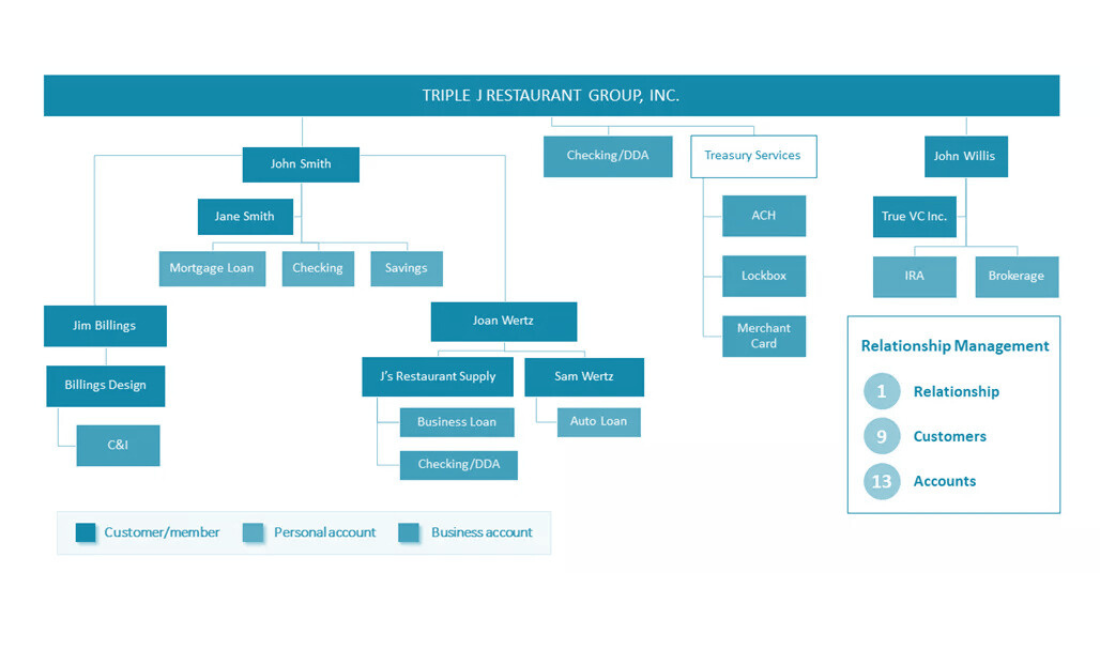

#1 — Define Relationships

Business relationships are complex and often include intertwined holding companies, subsidiaries, partnerships, family relations, and more. To manage each relationship profitably, you must have strong end-to-end knowledge of what constitutes a single relationship.

Figure 1: Definition of a relationship

Read more on how to improve your profitability:

How to Combat Mounting Competition from Neobanks

3 Ways to Drive Better Decision-Making at Financial Institutions