Hospital and Health System Operating Margins Stabilized Throughout Q2 Despite Rising Expenses and Shifting Demand, According to the Latest Strata Data

Consistent revenue growth helps offset rising drug and labor costs

CHICAGO — July 29, 2025 — U.S. hospitals and health systems closed the second quarter of 2025 on relatively steady financial footing, even as expenses continued to climb and patient demand shifted, according to new data from Strata Decision Technology.

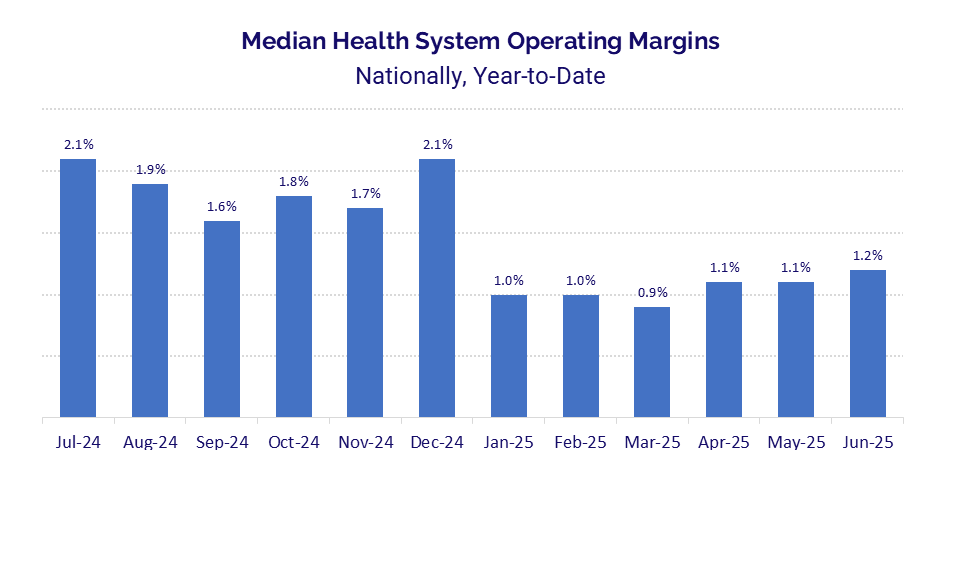

Health system operating margins remained narrow but firm at about 1% for a sixth consecutive month in June, signaling some resilience amid ongoing cost pressures. The median year-to-date (YTD) health system operating margin was 1.2% for the month, a slight improvement over 1.1% in May.

The nation’s hospitals also saw gains. The median change in hospital operating margin rose 2.4 percentage points from June 2024 to June 2025 and 1.3 percentage points from May to June 2025. Hospitals in the South led the margin growth, posting a 6.1 percentage-point increase year over year (YOY).

“This sustained stability in operating margins signals a notable level of resilience as hospitals and health systems combat ongoing economic pressures,” said Steve Wasson, Strata’s Chief Data and Intelligence Officer. “While rising drug and supply costs are straining budgets, healthcare leaders are finding ways to adapt operationally — including by shifting more care to outpatient settings and aligning resources more strategically.”

Rising expenses continue to pressure hospital finances. Drug costs rose sharply in June, jumping 9.8% compared to the same month in 2024. This increase outpaced growth in labor costs and contributed to an overall 8.2% increase in total non-labor expenses. Supply expenses were up 8.7% YOY, and purchased services increased 6.9%. Labor expenses, while more contained, still grew 3.8% versus June 2024. In total, hospital expenses climbed 5.1% YOY. Regionally, hospitals in the Northeast and West experienced the largest spikes in drug expenses, with YOY increases of 17.7% and 14.7%, respectively.

Patient demand presented a mixed picture. Outpatient care continued to gain momentum, with outpatient visits rising 8.2% YOY, as patients continue to seek care in lower-cost outpatient settings. Inpatient admissions increased 3.7%, while emergency department visits were down 5.2% and observation visits decreased 1.0%. By region, the South led in outpatient volume growth, with an 11.0% YOY increase.

Service line trends revealed that the normal newborn category saw the largest YOY increase in patient volumes at 5.1%, followed by hepatology and genetics, which each rose 4.6%. Conversely, ear, nose, and throat (ENT) services experienced the largest decline, with patient volumes down 8.2% compared to the same month in 2024.

Hospital revenues remained on an upward trajectory, growing across inpatient and outpatient categories for the 26th consecutive month. Outpatient revenue increased 12.3% YOY, while inpatient revenue climbed 7.0%. Overall, gross operating revenue was up 10.3% from June 2024 to June 2025.

Meanwhile, financial relief came from a decrease in bad debt and charity care deductions, which were down 3.0% YOY and 0.5% month-over-month for hospitals nationally.

About the Data

This report uses data from Comparative Analytics and Strata’s StrataSphere® database. Comparative Analytics offers access to near real-time data drawn from more than 152,000 physicians from over 10,000 practices and 139 specialty categories, and from 500+ unique departments across more than 1,850 hospitals. Comparative Analytics also provides data and comparisons specific to a single organization for visibility into how their market is evolving. StrataSphere is a unique and comprehensive data-sharing platform that helps providers leverage the power of a network that represents approximately 25% of all provider spend in U.S. healthcare. This report incorporates data from more than 650 hospitals from over 120 health systems with StrataJazz® Decision Support.

About Strata Decision Technology

Strata Decision Technology, LLC provides a cloud-based, enterprise performance platform for software, and data and service solutions to help organizations better analyze, plan, and perform in support of their missions. More than 2,300 organizations rely on Strata’s StrataJazz and Axiom solutions for financial analytics, planning, and performance management. Named the market leader for Business Decision Support for more than 15 consecutive years, Strata delivers first-class solutions and service, with an intense focus on accelerating innovation. For more information, please go to www.stratadecision.com.

Strata Social Networks

LinkedIn: Strata Decision Technology

Media contact:

Sally Brown, Inkhouse