‘Our Health Systems Are Not Too Big To Fail,’ CEO Warns

October 7, 2020

Strata Decision Technology has been tracking patient volumes, ED visits, length of stay, margins and telehealth utilization monthly for the past six months — and one reality that Strata’s latest data highlights is that fee-for-service payment models are problematic.

Strata began analyzing the data as COVID-19 hit the United States and in September the company published its 6-month update, which pointed to considerable spikes in the initial reaction and leveling off in the time since.

Health Evolution interviewed Strata CEO Dan Michelson about what the data reveals, misperceptions that continue, and what CEOs should consider for the rest of 2020 and moving into 2021.

Health Evolution: What surprised you about the findings? And what should CEOs understand about that?

Michelson: The elasticity of demand for essential care during the pandemic has been extraordinarily variable. Visits dropped 50%, admissions 25% and office visits 50% almost overnight. The need for screening and care didn’t go away but people made a trade-off between care and the risk of contracting COVID-19. For instance, breast health volumes are still down 37% since March even though overall daily volumes are back to 2019 levels. This makes fee-for-service a systemic risk to the health care sector.

We have to drive patient confidence to avoid future serious illness due to care delays. CEOs need to continue rethinking their volume– and procedure–driven economic models, channels of care, and access points. The way the industry creates margin has to be fundamentally evaluated. The pandemic has made it clear that the industry is not equipped to handle a severe supply shock and survive. Hospitals were rescued by the CARES Act this but the government may not come to our rescue again.

Health Evolution: Let’s take a reality check. What does your data illustrate about what’s really happening versus what’s being misconceived?

Michelson: Our health systems are not too big to fail. The belief that providers are “rolling in cash” due to high prices and market power just isn’t so. Margins across the StrataSphere network, even for the upper 25% of health systems, went to near zero and the median and bottom 25% saw negative margins. Well-financed, high market–share health systems fared better than others but the vast majority, particularly in smaller cities and rural communities, struggle to sustain services. The CARES ACT put many on stable footing for a few months but if the rise in COVID-19 cases drives hospitalizations and reduces people’s willingness to seek care again, we will see many on the brink again. We can’t allow that to happen. Our health systems in many parts of the country are also the largest employers, social hubs, and the safety net. They are far more important in most peoples’ lives than the banks were during the financial crisis of 2007-8. So while we can and should continue to focus on things like cost structures, waste, where investments should be made, salaries, and prices, we need to take steps to ensure the viability of our health systems. It is clear now that it doesn’t take much of a shock to drive an industry-wide collapse.

Dan Michelson, Strata Decision Technology

Health Evolution: Early on it appeared many health care organizations were headed for financial collapse. What is the status now among the organizations you surveyed and what does it suggest about the future?

Michelson: The CARES Act provided a lifeline when revenues plummeted, without which we would have seen a large portion of the industry “fail.” Even today we are seeing health systems in which volumes aren’t returning continuing to furlough employees and let people go. We see recovery in many health systems, but the margin mainstays from large procedural areas are still lagging. We expect that financial performance may lag for some time and that organizations will have to find ways to generate revenue that will not be impacted by another overwhelming drop in volume, such as engaging in more value-based payment arrangements.

Health Evolution: What did you find after six months of tracking the data relative to inpatient volumes, admission rates, length of stay and ventilator use?

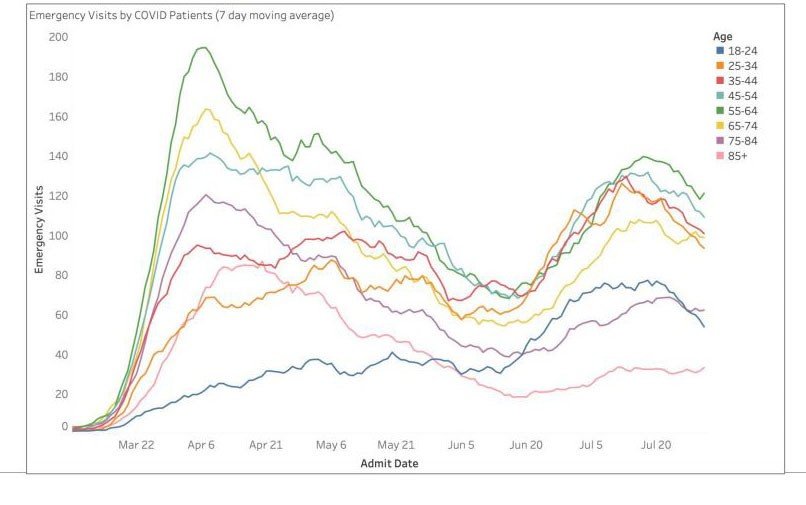

Michelson: Health care systems have figured out how to handle COVID-19 and simultaneously safely see patients with other issues. COVID-19 admissions as a percent of total admissions fell to less than 10% in all regions during the study period, after reaching a high of nearly 40% in the Northeast. Patients in the older age groups continue to dominate COVID-19 hospital admissions. While there is a significant increase in visits to the emergency room by 18-35- year-olds, their hospital admission rates remain comparatively low. Admission rates from the ED are declining across all age cohorts, suggesting providers have developed more skill in identifying who has COVID-19 and should be admitted as well as optimal treatment. The industry responded incredibly well to COVID-19 despite the 200,000 who have died and countless others who’ve been impacted. The remarkable cooperation and learning exchange across the industry cut mortality rates by 50% in just a few months. Moreover, admission rates are down across age groups and the need for mechanical ventilators has plummeted. Contrary to popular wisdom, hospitals are not getting overpaid for COVID-19 with the 20% increase in payment from HHS. Length of stay for COVID-19 cases is 20% higher than non–COVID patients. For now, costs are higher for COVID patients.

Health Evolution: And what about outpatient volumes and ER visits?

Michelson: Outpatient volumes have rebounded, and for chronic care and screening they are even above 2019. ED volumes continue to be down by 25% after reaching a low of 50% down. The very nature of the ED may be changed for a long time to come.

Health Evolution: We’ve all heard about the boom in telehealth earlier in the pandemic. Then virtual visits settled down but were still happening at much higher percentages than prior to COVID-19. What levels are they now? And what does the data suggest about the future of telehealth?

Michelson: Telehealth soared and filled a void during the pandemic and was utilized for almost 50% of office visits at the peak. However, telehealth office visits declined to about 11% of all visits by this Summer, and have remained steady, reflecting the hands-on nature of health care.

Some surprises within the data include that, contrary to the belief that technology is for the young, telehealth utilization was strong across all age cohorts. Some visits types like Behavioral Health sustained telehealth volume better than others while phone check-ins, basic follow-ups and consultations show weakness. Overall, the data makes clear that telehealth has now come into its own as a critical access channel. Providers need to architect their delivery to maximize access and effectiveness.

Health Evolution: Taking all of the above into consideration in looking back at 2020 thus far, what is the takeaway for the rest of the year and into 2021? What should CEOs be thinking about?

Michelson: Health systems must evaluate their financial dependency on procedures and FFS models vs. chronic and disease care under value-based arrangements. Under- and over-care and unjustified variance in care all need to be further reduced through financial incentives from payers. Also, chronic and elder care should be national priorities, dabbling in digital is not nearly enough, and shutting down care again will lead to downstream illness burden. We have to continue to learn and manage COVID-19 so we’re able to treat those with the disease without limiting access to care for others.