Rolling Capital: Managing Investments in a Value-Based Care World

June 2, 2016

A ROLLING APPROACH TO CAPITAL PLANNING OFFERS HEALTHCARE PROVIDERS FLEXIBILITY AND EFFICIENCY, WHICH ULTIMATELY IMPROVES PATIENT SATISFACTION AND HELPS CONTROL COSTS.

Accurate capital planning in health care is growing ever more challenging because it requires a long-term perspective at a time when technology and society seem to be in constant flux. The traditional budgeting process offers no help. For example, no one wants to explain to his or her leadership team that significant budget variances were a result of misjudging the ongoing operational impact of newly purchased equipment—which has supply costs unexpectedly 125 percent higher than the old equipment—during the capital budget review process. Yet this type of scenario is all too commonplace among healthcare organizations today, and it’s not hard to see why.

The change the healthcare industry has seen over the past five years shows no signs of slowing. Organizations are growing, often through mergers and acquisitions, at the same time they are rushing to find new ways to drive down costs in response to the industry’s shift from a volume-based payment model to one focused on performance and quality. All of these changes have a direct impact on those responsible for capital investment planning, and they require a more adaptable approach than traditional capital investment planning—one that is open to review and adjustment more than once a year. A rolling budgeting process that is continually updated, a month or a quarter at a time, can be extended to capital planning activities to offer a much more nimble financial tool.

The Impact of Value-Based Care on Capital

In a value-based environment, healthcare providers assume responsibility for caring for a population of patients across a continuum of care. No longer do patients receive all services at one specific location. This new reality is forcing organizations to redefine how they are making investment decisions and to assess the value of their investments outside the four walls of their hospital.

Value-based care demands an increased focus on quality and cost savings. Organizations are looking for ways to get more for less, to enhance their purchasing power, and/or lower overall price per unit. If an organization has $100,000 to spend on capital and can negotiate a 10 percent price reduction, that equates to $10,000 in freed up capital to replace more devices or invest in new services. It means adopting the same mindset that healthcare organizations have been applying for the past decade to reduce supply costs or outsource services such as laundry.

Lessons from Other Industries

To ensure solid investment decisions are being made based on value, many hospitals and health systems are moving away from the traditional once-a-year capital planning process and adopting a more flexible and more accurate rolling approach, following the model of other capital-intensive industries such as airlines and manufacturing.

If you look at an airline’s fleet of planes, you will notice the standardization. The company picks a manufacturer, make, and model for a particular service route—short, long, or international—because it reduces safety events, requires a lower inventory of parts, makes it easier to have trained maintenance crews everywhere, and contributes to improved employee satisfaction. The airline operates under a long-term strategy, but it reevaluates and makes changes to timing and quantity based on operational performance and other factors.

Similarly, large manufacturing organizations have five-year plans that include strategic initiatives, as well as plant replacement plans. These capital plans are reviewed every quarter, focusing on the next 24 months as well as projects underway. Just because a project starts does not mean that it won’t be delayed or stopped entirely. Manufacturing leaders want their teams working on the portfolio of capital investments that will bring the most value to their organizations. If a new technology emerges or is released to the market faster than planned and will bring cost savings to the organization, they reprioritize and bring the project forward even if that means another project is pushed back or an active project is delayed. Manufacturing company shareholders expect them to take in new information and adjust so that they can:

- Reduce costs

- Standardize to minimize risk

- Minimize workplace accidents

- Adhere to regulatory changes

- Take advantage of new technologies

- Bring new products to market faster

Adopting a similar approach to capital planning in health care ultimately will contribute to improved patient satisfaction.

The Historical Approach to Capital in Health Care

Historically, capital planning has been performed using one of two processes: discrete identification and a hybrid of discrete identification and funding pools. Organizations would try to identify and budget for each individual or discrete capital investment project once a year. These capital projects ranged from large strategic initiatives to individual pieces of equipment or systems that needed to be replaced or upgraded. Unfortunately, both of these approaches pose difficulties that limit their usefulness.

Discrete Identification

The discrete identification process presents poses distinct challenges for healthcare organizations due to four inherent shortcomings.

Inefficiency and tediousness. Hundreds of resource hours are spent creating and reviewing projects. The process taxes the functional areas (IT, facilities, clinical engineering, purchasing, and finance) that need to properly vet the initiatives, prepare cost and revenue models, and obtain quotes. Missed assumptions lead to variances in the original budget, and in operational performance once a project is placed into service.

A lack of data. The metrics that operational and service-line leaders require to properly identify which assets can be maintained and which must be replaced do not exist, creating a serious concern because the investment decisions have long-term consequences.

Inflexibility. Healthcare organizations are unable to react to opportunities that arise during that year.

Predictable carry-over. Single-year planning often leads to a carry-over of capital funds to the next fiscal year when planned projects do not start and/or are not completed on time. As a result, the organizational benefits are not realized in the planned time period. Furthermore, most organizations do not have the discipline to layer in the impact their capital investment portfolio would have on their operating budget, which leads to variance throughout the following years. For example, project implementations spanning multiple fiscal years can affect future years’ operational plans if the operations team hasn’t included previously approved projects in the upcoming operating budget cycle.

Hybrid of Discrete Identification and Funding Pools

Some healthcare organizations have adopted the hybrid approach because they have found budgeting for every discrete capital investment to be simply impossible. With a hybrid approach, organizations continue to use the discrete budgeting process for large, strategic projects. Meanwhile, however, for projects below a certain threshold and items needed to maintain operations—e.g., systems, equipment, and infrastructure—the organizations also provide a pool of investment funds to a region, entity, or service line, which is then able to control and use those dollars to fund the smaller projects.

The hybrid approach does help resolve some of the problems inherent in a discrete planning process. But it introduces others, including the following.

A lack of accountability. Pools lead to less accountability, as well as the use of less rigorous analytics in validating the need and the ongoing benefits, or costs, to the organization over the life of the investment project.

A decrease in standardization. As a result of decentralization across the organization, individual regions, entities, and service lines are able to make decisions regarding manufacturer, make, and model based upon their preferences. A larger number of vendors for each taxonomy of assets leads to increased operational expenses. It takes more parts, training, and resources to support a vast variant compared to a smaller mix of equipment.

More variation in patient care. Achieving repeatable results across a large healthcare organization is more difficult when the equipment, configuration, and systems used to provide care differ.

A reduction in purchasing power. Organizations cannot negotiate as well and obtain the lowest acquisition costs when there is no detailed plan and consistency of need across the organization.

The Rolling Capital Option

Rolling capital is an alternative approach to planning that enables organizations to incorporate changes in information, market, technology, regulation, and operational performance and adjust as needed. It helps organizations properly vet and analyze strategic initiatives for large threshold projects. Using metrics, it helps organizations identify and diagnose the criticality of their assets, prioritize those most in need of repair or replacement, take immediate action, and reduce carry-over.

A rolling capital system keeps the organization focused on both short-term operational results, as well as ensuring the team can properly plan for the next three to five years. With the right systems and metrics, staff spend less time inputting data and more time performing analytics and reviewing trends, volumes, and costs.

Implementation Process

Unlike the traditional annual budget cycle, a rolling capital approach enables organizations to maintain alignment between operational performance and the capital investment portfolio, anticipate upcoming expenditure, and maintain tight control over cash outflows, and incorporate changes.

Typically, a rolling capital planning approach comprises the following steps in an ongoing quarterly cycle:

- Updating the rolling operational financial forecast

- Reviewing forecasted spending for projects underway and planned of the next 12 to 24 months

- Adjusting the operational plan, including capital capacity, as needed

- Confirming capital portfolio alignment and value

- Adjusting capital projects (e.g., delay, bring forward, cancel, or release funds)

Organizations can transition to a rolling capital approach in phases. Typically, an organization’s value investment portfolio will be the easiest to transition to the rolling approach will be the portfolio, and the maintain portfolio (i.e., investments in equipment, IT systems, and buildings and facilities to maintain the quality and services the organization delivers to the community) will require more time for such a transition.

The transition itself involves five key steps:

- Identifying capital investment portfolio groups

- Establishing prioritization and evaluation metrics for each portfolio

- Establishing a centralized team and tool for the maintain portfolio

- Evaluating and prioritizing the workflow

- Reviewing the overall portfolio

Identification of capital investment portfolio groups. Portfolios for similar projects should be established using a “margin plus mission” philosophy. All projects in a portfolio should be vetted using the same type of criteria. The aim for the combined investments across an organization’s portfolios should be to achieve the overall goals for the organization’s total capital investment portfolio—include net operating income, ROI, and internal rate of return. The goals for each individual portfolio will vary, but significantly higher returns on the investments in the value and cost-reduction portfolios will be required, and therefore anticipated, to offset the maintain portfolio, which may have a negative effect.

The margin group of investments exists to maintain or improve current operations and includes investment in equipment, systems, and buildings to maintain the quality of care and the patient population the organization services today. New technology will be introduced that may allow the organization to deliver additional services or reduce costs, but the main reason for an organization to invest within this portfolio is to maintain the level and quality of the services it delivers to its current patient population.

Investments in quality of care and employee safety also fall within margin group. These include investments into the operations of an organization that will significantly affect the quality of care or reduce harmful events for patients and employees, such as reducing the occurrence of avoidable readmissions, non-billable visits, and worker’s compensation events.

One margin portfolio goal, for example, might be to ensure the collection of investment initiatives has a $0 net impact on net operating income (supplies, labor, maintenance).

The mission group of investments are meant to increase value or reduce costs.

Consolidating services to a more central location that is easily accessible by public transportation, investing in facility aesthetics, and providing new services are examples of value investments. The goal for such a portfolio might be to achieve a 4 percent overall return on collection of investment initiatives and a payback of five years.

Cost-reduction investments are those that significantly reduce the operational costs of the organization. Investing in a new fleet of vehicles or a boiler system that runs on biofuel resulting in a 50 percent reduction in utility costs starting in year one are examples of cost-reduction investments. The goal for the cost-reduction portfolio might be that the collection of projects will have a payback period of less than two years.

Establishment of prioritization metrics. Metrics should be established for evaluating projects in each subportfolio to assist the organization in assessing projects and making the best decisions for the organization, the employees, the community, and the patient population. Even though a project may meet the acceptance criteria, it still may not be approved if it does not align with the organization’s overall portfolio goals. Trade-offs still need to occur.

The analysis should consider multiple scenarios and incorporate the capital constraints and metrics to assist in portfolio selection. Different types of metrics should be established for evaluating investment projects within different subportfolios.

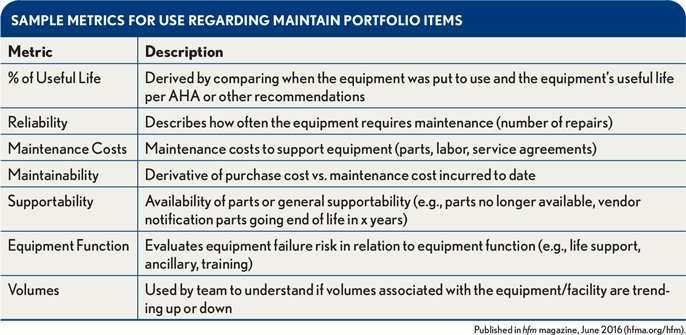

Data-driven metrics, for example, are important for evaluating equipment and facilities and allocating funds in the maintain portfolio. Assigning an overall “criticality” score to each individual piece of equipment or facility based upon several metrics allows funds to be allocated where they are most needed rather than giving the funds to an entity or region based upon financial performance. Highest scores are given highest priority for replacement. The exhibit below shows examples of metrics that can be useful in this area.

Sample Metrics for Use Regarding Maintain Portfolio Items

The projects in the value and cost reduction portfolios will be business-case-driven and will have a combination of quantitative and qualitative metrics. Qualitative metrics should be assigned a numerical value to provide a transparent, rational, and objective process that removes emotions and politics from the decision-making process. The financial ratios such as payback, net present value, and internal rate of return can differ for each portfolio. For example, more aggressive ratios may be appropriate for the portfolio of cost-reduction investments.

Quantitative metrics include things like the number of patients or members, cost avoidance, and market penetration. By contrast, qualitative organizational parameters include financial goals, quality, and satisfaction. During the evaluation process, a numerical value is assigned based on alignment with the goal. In an example scale, a value of 100 would be given for total alignment, 75 for high alignment, 50 for some alignment, 25 for little alignment, and 0 for no alignment.

Establishment of centralized maintain portfolio team and tool. A centralized team should be established and should be charged with focusing solely on the maintain portfolio. This portfolio requires special attention because it presents the greatest opportunity to drive down acquisition costs, to reduce harmful events due to variability in equipment across the organizations, and to reallocate equipment to other service areas.

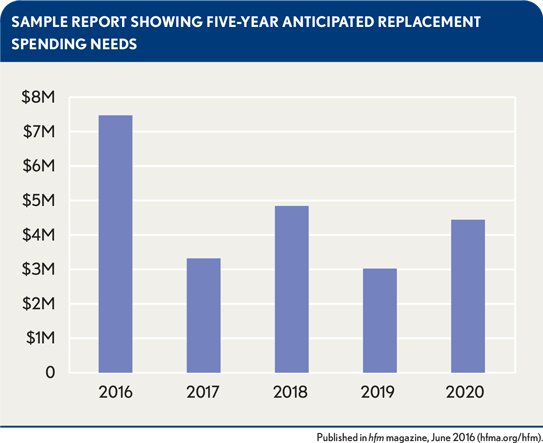

A set of data-driven metrics can assist the team in evaluating and identifying the equipment that is in the most critical need for replacement each quarter. The team also should establish both guidelines for future acquisitions (i.e., manufacturer, make, and model) and agreements with vendors on pricing based on the expected replacement volumes for the next 24 to 60 months. The team should be held accountable for driving down acquisition costs, ongoing operational costs, and harmful events affecting both patients and employees associated with the maintain portfolio of investments. Tools should be implemented that help the team by providing a global view of all equipment and facilities and enabling the team to run scenario analytics and predict the spending needed for the next 3 to 5 years.

Sample Report Showing Five-Year Anticipated Replacement Spending Needs

Evaluation and prioritization of workflow. Appropriate workflow vetting steps should be established for each portfolio of projects, including gathering the information required for each project. It is important to establish a project champion whose clearly articulated role should include ensuring time is not wasted by functional teams.

The portfolio of projects should be reviewed each quarter to allow for adjustments (e.g., delay, bring forward, cancel).

The following the steps offer on example of a process for launching a project in the value portfolio:

- Proposal entered by requestor

- Project champion review

- Functional review performed by clinical engineering, IT, facilities management, and business development—high-level estimate

- Project champion review

- Gate 1 approval by capital committee (if approved, process continues)

- Business plan updated by requestor

- Second functional review performed—detailed business case

- Purchasing and finance review

- Project champion review

- Gate 2 approval by capital committee (if approved, process continues)

- Release of funds—by phase (e.g., architecture design)

- Portfolio evaluated each quarter and project adjusted as needed

Organizations should not hesitate to delay or cancel projects that have already started, if necessary. It is good business sense to alter course should another important opportunity become available or the situation change significantly due, for example, to a market or regulatory shift.

Reviewing the overall portfolio. It is important that the organization’s overall portfolio deliver the expected return across the investment portfolio. If not, adjustments will be needed, such as moving forward investments that deliver more value and delaying others in accordance with overall portfolio goals. Establishing a process to validate that the portfolio is on track to deliver the expected results is important, as being able to make course corrections as needed.

Benefits of Rolling Capital Planning

Organizations that use a rolling capital planning approach enjoy a continuous process that integrates strategic, operating, and capital financial planning, resulting in reduced costs, increased flexibility of staff, and reduced risk with regard to quality of patient care, harm to employees, and operations. These improvements are largely attributable to four factors.

Greater standardization. Rolling capital lets organizations plan out multiple years and determine the right strategy for facility maintenance and standardization of equipment, infrastructure, and systems across the entire health system.

Reduced labor intensity. With a rolling capital approach, managers can focus on strategic projects rather than having to pore through lists of equipment, systems, and infrastructure seeking to identify which individual items they want to submit for replacement, and then obtaining quotes and having the functional team s review the proposed projects. Meanwhile, functional teams are not burdened with reviewing and analyzing every individual capital project proposal to determine its completeness.

Reduced costs. Visibility into replacement needs for the next five years allows for identification of group purchasing and bundling opportunities and enables organizations to negotiate more effectively with vendors, thereby reducing expenditures.

Transparency. A rolling capital approach provides visibility into how decisions are made. Teams use data and metrics as they becomes available to make decisions, making them less susceptible to politics or guesswork. A rolling plan lays out what the organization is investing in, when the investment is being made, and why.

Routine Replacement

A important additional advantage of a rolling capital planning process, tied to transparency, is that it provides a means to facilitate routine replacement of critical equipment and systems. The identification of routine replacement equipment and systems is one of healthcare management’s most difficult and time-consuming responsibilities, which is why a rolling capital forecast is key. Organizations can realize substantial benefits from a system that automatically updates on a quarterly basis and incorporates key metrics such as volumes, work orders, quality events, and technology obsolescence. Such systems enable a centralized team to analyze the changes and identify the most critical assets to replace in the next quarter. Equipment is replaced based upon critical need rather than being allocated out to regions, entities, or service areas based upon a financial metric.

The best practice is to identify a cross-functional team that is responsible to work with operations to properly plan for the future, specifically identifying replacement technology and establishing pricing with vendors.

Tips for Success

Organizations striving to implement a rolling capital budget can benefit from lessons learned by early adopters of this type of budgeting process.

Expect to be met with resistance initially. Changing to rolling capital planning takes away control of funds, but relying on metrics and data is effective in overcoming such opposition.

Communicate with stakeholders. The benefits the organization expects to achieve should be clearly articulated and communicated, as should the successes achieved.

Plan for training and development. The shift to a rolling process will allow more time for individuals to be strategic, review data, and perform analyses. However, not everyone who plays a role in budgeting will have developed these skills, so it’s important to establish a plan to assist with professional growth.

Identify the data elements and source systems that will be used. IT expertise should be engaged to assist with standardizing reports and/or identifying a system that ensures data are readily available and easy to update.

Take a phased approach to implementation. Organizations may want to migrate first to a hybrid approach before embarking on a rolling capital process. Alternatively, organizations can start by incorporating only their strategic initiatives into a rolling approach, and then phase in routine replacement.

As the healthcare industry shifts to value-based care, it is important for healthcare organizations to fully understand the impact capital investment decisions can have on quality and operational flexibility. A rolling capital approach can help organizations maintain alignment between operational performance and the capital investment portfolio, anticipate upcoming expenditures, and retain tight control over cash outflows, they also can reduce overall risk in terms of quality of patient care, harm to employees, and satisfaction.

Lynette Jasuta, MBA, is the practice director of capital planning, Strata Decision Technology, Chicago, and a member of HFMA’s First Illinois Chapter.