Soaring Drug and Supply Expenses Undercut Hospital and Health System Margin Growth

CHICAGO, IL — November 4, 2025 — U.S. healthcare organizations continued to face mounting expense pressures at the end of the third quarter, with operating margins showing little change despite steady growth in gross revenue. Persistent expense increases — particularly in drugs and supplies — continued to weigh on hospital and health system performance even as revenues rose and patient volumes shifted further toward outpatient care, according to the latest data from Strata Decision Technology.

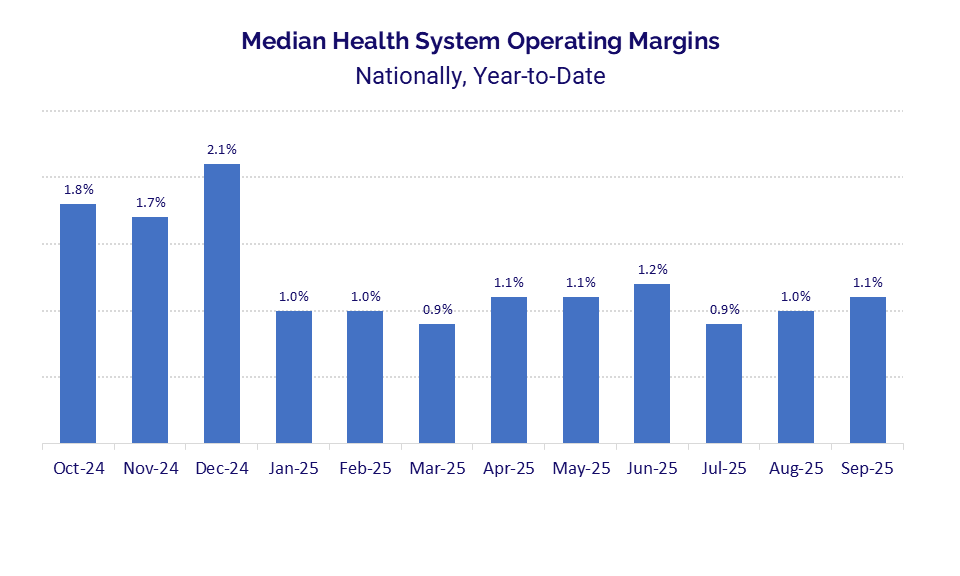

Health system margins inched upward for the second consecutive month, with the national median year-to-date (YTD) operating margin rising from 1.0% in August to 1.1% in September, though margins remained thin and consistent with levels seen throughout 2025.

Drug and supply expenses saw double-digit year-over-year (YOY) growth, jumping 12.8% and 12.1% from September 2024 to September 2025, respectively. These increases contributed to broader expense increases, with total non-labor expense climbing 9.3% YOY and outpacing the 5.0% increase in total labor expense. Overall, total hospital expenses rose 7.5% YOY to close the third quarter.

“Operating margins have faltered throughout the first three quarters of 2025 as healthcare organizations feel the full weight of rising expenses,” said Steve Wasson, Chief Data and Intelligence Officer at Strata Decision Technology. “Unfortunately, this has become an all-too familiar story that healthcare leaders will continue to grapple with for the foreseeable future as they navigate the impacts of tariffs and other economic forces affecting the industry. To sustain performance in this environment, organizations must continue to be disciplined in aggressively managing expenses and responding to shifting market demands.”

Regional trends underscored uneven financial pressures across the country. Hospitals in the Midwest experienced the steepest increase in drug expenses, up 17.3% from September 2024 to September 2025, followed by those in the West at 15.7%. Hospitals in the Northeast saw an 8.7% YOY increase, while those in the South recorded a more moderate 3.4% YOY gain.

At the same time, patient demand for outpatient services continued to climb. Outpatient visits rose 9.8% YOY nationally in September, with the South and Midwest leading at 11.5% and 11.1% YOY growth, respectively. Inpatient admissions increased 5.3%, observation visits rose 1.5%, and emergency visits declined slightly by 0.5% over the same period. Gross operating revenue mirrored these utilization patterns, increasing 11.4% YOY, driven by a 12.8% increase in outpatient revenue and a 9.8% rise in inpatient revenue.

Physician practices saw some signs of relief. The level of investment required to support practice operations decreased YOY for the first time in 2025. The median investment per physician full-time equivalent (FTE) was $311,264 in the third quarter, down 4.7% from the prior quarter and down 1.8% from Q3 2024. Median total expense per physician FTE remained around $1.1 million, up 3.9% YOY but down 1.3% compared to Q2 2025.

About the Data

This report uses data from Comparative Analytics and Strata’s StrataSphere® database. Comparative Analytics offers access to near real-time data drawn from more than 135,000 physicians from over 10,000 practices and 139 specialty categories, and from 500+ unique departments across more than 1,850 hospitals. Comparative Analytics also provides data and comparisons specific to a single organization for visibility into how their market is evolving. StrataSphere is a unique and comprehensive data-sharing platform that helps providers leverage the power of a network that represents approximately 25% of all provider spend in U.S. healthcare. This report incorporates data from more than 650 hospitals from over 120 health systems with StrataJazz® Decision Support.

About Strata Decision Technology

Strata Decision Technology, LLC provides an innovative, cloud-based platform for software, and data and service solutions to help healthcare organizations acquire insights, accelerate decisions, and enhance performance in support of their missions. More than 2,300 organizations rely on Strata’s StrataJazz and Axiom solutions for market-leading service and enterprise performance management software, data, and intelligence solutions. To learn more about Strata and why the company has been named the market leader for Business Decision Support for more than 15 consecutive years, please go to www.stratadecision.com.

Strata Social Networks

LinkedIn: Strata Decision Technology

Media contact:

Sally Brown, Inkhouse