U.S. Hospital and Health System Operating Margins Stagger in November, According to New Strata Data

Hospitals experienced increased financial pressures toward year’s end

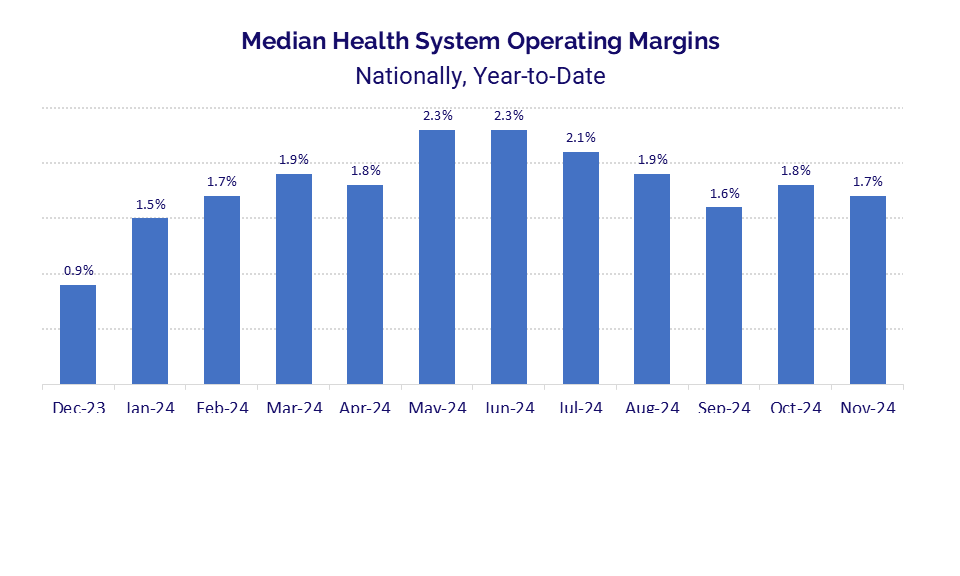

CHICAGO – Jan. 7, 2025 – Hospitals and health systems nationwide saw operating margins narrow in November as patient demand waned and expenses continued to grow, according to new data from Strata Decision Technology.

The median year-to-date (YTD) health system operating margin decreased from 1.8% in October to 1.7% in November, marking a fourth drop for the metric in the past five months. The median YTD hospital operating margin decreased for a second consecutive month, from 4.9% in October to 4.7% in November.

“Our data reflect mounting financial pressures for hospitals and health systems as they neared the end of 2024,” said Steve Wasson, chief data and intelligence officer at Strata Decision Technology. “The persistent margin decreases for health systems throughout much of the second half of the year are particularly concerning. December’s data will provide greater clarity as to whether these pressures will continue into 2025, but the outlook at this point is not encouraging.”

Analysis of margin changes over time show that the median change in operating margin for hospitals nationally was flat year-over-year (YOY) and dropped 1.9 percentage points month-over-month. Margin changes varied by region. Hospitals in the Northeast/Mid-Atlantic had the biggest YOY decline at 0.7 percentage point, while those in the Midwest had the biggest YOY increase at 0.8 percentage point.

High expenses contributed to November’s margin pressures, with total expenses rising YOY across both labor and non-labor metrics. Purchased services had the biggest increase at 8.2% YOY, helping to drive a 5.0% increase in total non-labor expense and a 4.7% increase in total expense over the same period. Total labor expense was up 5.4% from November 2023 to November 2024.

Expenses also increased across most metrics on a per-patient basis. Labor expense per adjusted discharge had the biggest increases at 2.3% YOY and 4.6% month-over-month. Non-labor expense per adjusted discharge rose 2.0% YOY and 2.7% month-over-month, and total expense per adjusted discharge was up 1.5% YOY and 3.3% from October to November 2024.

Lower patient demand further contributed to margin pressures, with November volumes down across inpatient and outpatient metrics versus both prior year and prior month. Emergency visits had the biggest YOY decrease at 7.6%, followed by observation visits at 3.5%. Outpatient visits decreased 0.6% and inpatient admissions were down 0.3% from November 2023 to November 2024. From October to November 2024, hospital outpatient visits dropped 13.5%, emergency visits decreased 12.1%, observation visits were down 8.7%, and inpatient admissions decreased 6.6%.

Gross hospital revenues continued to grow, even as expenses rose and patient volumes decreased. Outpatient revenue was up 4.5%, inpatient revenue rose 2.8%, and gross operating revenue was up 3.9% from November 2023 to November 2024, marking the 19th consecutive month of YOY increases for the three metrics.

Month-over-month, however, hospitals saw gross revenues drop. Outpatient revenue was down 10.1%, inpatient revenue decreased 6.0%, and gross operating revenue was down 8.6% from October to November 2024. Net patient service revenue (NPSR) per adjusted discharge increased across both measures, rising 1.4% YOY and 1.0% month-over-month.

About the Data

This report uses data from Comparative Analytics and Strata’s StrataSphere® database. Comparative Analytics offers access to near real-time data drawn from more than 135,000 physicians from over 10,000 practices and 139 specialty categories, and from 500+ unique departments across more than 1,600 hospitals. Comparative Analytics also provides data and comparisons specific to a single organization for visibility into how their market is evolving. StrataSphere is a unique and comprehensive data-sharing platform that helps providers leverage the power of a network that represents approximately 25% of all provider spend in U.S. healthcare. This report incorporates data from more than 600 hospitals from over 120 health systems with StrataJazz® Decision Support, as reported in the National Patient and Procedure Volume TrackerTM.

About Strata Decision Technology

Strata Decision Technology, LLC provides an innovative, cloud-based platform for software, and data and service solutions to help healthcare organizations acquire insights, accelerate decisions, and enhance performance in support of their missions. More than 2,300 organizations rely on Strata’s StrataJazz and Axiom solutions for market-leading service and enterprise performance management software, data, and intelligence solutions. To learn more about Strata and why the company has been named the market leader for Business Decision Support for more than 15 consecutive years, please go to www.stratadecision.com.

Syntellis Social Networks

LinkedIn: Strata Decision Technology

Media contact:

Sally Brown, Inkhouse