Inpatient Volumes, Surgeries Continue to Lag Amid COVID-19

September 23, 2020

While patient volumes have started to rebound from the significant drop at the beginning of the COVID-19 pandemic, many specialties haven’t returned to 2019 levels, according to a new analysis of patient and procedure volumes released Wednesday.

That slow recovery is concerning for hospitals, many of which experienced negative margins in March and April as patient volumes dropped.

Even where patient volumes are approaching 2019 levels, many encounters seemingly lost during the early spring haven’t been recovered, according to the report from financial analytics company Strata Decision Technology. Strata analyzed data from 275 U.S. hospitals across 58 systems using the company’s data-sharing tools for the report.

Outpatient visit volumes have recovered more strongly than inpatient volumes, according to Strata’s findings.

While outpatient volume was down 56% in April, it was up 15% year-over-year in August. Early data for September, however, suggests a 7% dip.

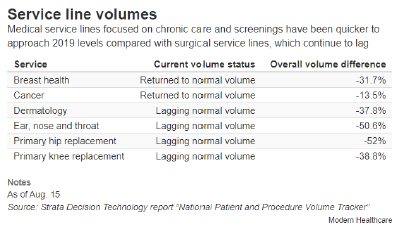

Inpatient volume, down 27% in April, is still down 5% as of August. Medical service lines have rebounded more than surgical service lines, suggesting returning inpatients have focused on chronic, preventive and screening care, according to Strata’s report.

Inpatient procedures and surgeries, which tend to be high-margin items, are still down 18.6% cumulatively.

Service lines like breast care, cancer and cardiology are nearing 2019 levels, according to the report.

COVID-19’s effect on care should encourage the healthcare industry to re-evaluate financial models, said Dan Michelson, Strata’s chief executive officer.

It’s possible inpatient volumes won’t ever fully recover, he said, with a so-called “new normal” at 90% to 95% of previous volumes. For hospitals already operating on thin margins, “their volume falling about 5 or 10% can be pretty devastating.”

That patient volume change, as well as uncertainty around when the COVID-19 pandemic will subside, could accelerate a shift to value-based care, he said. Strata in its report calls the fee-for-service model a “systemic risk,” writing it has led hospitals to become financially dependent on procedures, while value-based arrangements would support more chronic and disease care.

“The wheels come off when the procedure volumes drop,” said Steve Lefar, executive director of Strata’s data science group.

Other recent analyses of healthcare utilization have also shown patient volumes returning below pre-pandemic levels.

An analysis of visit volume data from customers of Phreesia’s patient intake software published by the Commonwealth Fund last month found weekly visits at ambulatory practices have plateaued at 10% below the volume seen in early March. That’s up from the initial 60% drop identified in early April but suggests a substantial number of lost visits since the spring.

In Phreesia’s dataset, visits to specialties including dermatology, ophthalmology, adult primary care, oncology and OB-GYN had most closely returned to pre-pandemic rates.

Pediatrics, pulmonology and orthopedics experienced the biggest lag behind baseline rates.

And preventive care hasn’t fully recovered. Mammograms and Pap smears were down nearly 80% in April and nearly 25% in June, according to an analysis of claims data from the Health Care Cost Institute published earlier this month.

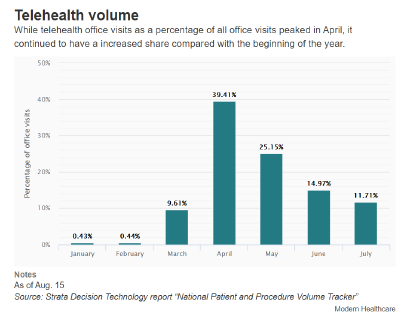

Telehealth, which provided an interim avenue for physicians to continue seeing patients even when hospitals closed their doors for non-emergency care, has declined since hospitals began reopening.

That said, telehealth utilization in the summer still sat at a notably higher rate than before the pandemic.

At one point in April, telehealth accounted for nearly half of daily office visits, according to Strata’s report. However, telehealth utilization has since fallen to just 11% of office visits as in-person appointments have become a viable option again.

Prior to the pandemic, telehealth accounted for less than 1% of January and February office visits.

Behavioral health has sustained telehealth volume throughout the spring and into the summer, according to the report.

Rick Kes, a partner and healthcare senior analyst at RSM, said the audit and consulting firm’s healthcare clients experienced “incredible growth” in telehealth in the early spring, which has curtailed since April.

But “there’s still a lot of energy and excitement around what telehealth might mean for the industry at large,” Kes said, citing Amwell’s recent initial public offering and Teladoc Health’s plans to merge with Livongo. Hospitals are now figuring out the best way to integrate telehealth into care delivery; providers could begin performing initial consultations and taking medical histories remotely, with procedures completed on-site, he said as an example.

“Maybe not everything related to a specific specialty or sub-specialty needs to happen in an office,” he said. It’s thinking about “what can we do remotely, versus what do we have to do physically?”